What goes up must come down, to go up again…

Many investors had big moments in the past two years. After the hit that the stock market suffered with COVID-19, everything pretty much set in a good direction. S&P 500 grew 16 percent in 2020 and almost 27 percent in 2021. This caused a rush of individual investors to get into trading, getting into stocks like GameStop and AMC, benefitting from a quite defined bull market. Some took a chance with cryptocurrencies like Bitcoin (BTC), which hit above $60,000.

The environment and excess of excitement perhaps made it easy to forget that bull markets do not last forever (for details on this, please, visit our FAQs section). Often the markets drop much faster than the time they took to climb.

Markets going down

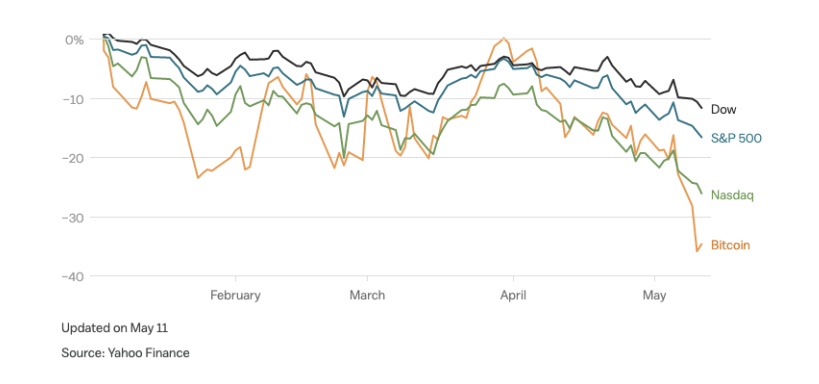

The S&P 500, Dow Jones Industrial Average and the Nasdaq were recently well behind where they were at the start of 2022, down 16%, 12% and 26%, respectively. In recent past, Nasdaq and Dow hit their worst single-day declines since 2020. S&P 500 hit its lowest level in a year. Bitcoin, which has for long been seen as a form of digital gold that could serve to mask market turmoil, also fell below $30,000 repeatedly in a week, less than half of where it was near the $69,000 top in late 2021.

Earlier May 2022, stocks got shaken after the release of the latest inflation numbers from the Bureau of Labor Statistics. Inflation is close to the highest in a 40 years period. Investors are in doubt of what is yet to come and what policymakers will propose to be made. When the storm is at its peak, apparently, there’s no safe place but the stocks or the markets don’t go down forever. The armed conflict between Russia and Ukraine has not contributed positively to this either.

Fear the unknown - Why Wall Street is anxious and what economy has yet to suffer

Markets do what they do because of a set of different reasons. There’s not only a single explanation for it. Stocks rise and fall. Investor sentiment changes without warning. In face of what is happening right now, investors are emotion-scattered and they should.

Inflation is a problem in the United States and affects populations worldwide. US inflation rate hit the highest peak in 40 years, In April, the Consumer Price Index, was up by 8.3% YoY and 0.3% MoM. The interest rates were raised by the Federal Reserve and the balance sheet will soon be reduced to reduce inflation and get prices back under control.] These moves may be necessary but at the same time they’re making Wall Street nervous.

Analysts at Goldman Sachs estimate that there’s a 38% chance of the United States economy entering a recession in the upcoming 2 years. Deutsche Bank has envisaged a recession too, softer in the beginning than it will be afterwards.

What goes up must come down a bit (or a lot)

Many markets have been floating high, very likely higher than they should have been.

Every time the S&P has been higher than 20 percent or more over the course of 1 year since WWII, investors would benefit from some of the gains at the start of the new year.

Nasdaq and Russel 2000 have already fallen bearish (please refer to “What is the meaning of going bullish and bearish in trading?”), thus they are 20% off their recent peaks which may be a warning that S&P 500 might follow soon.

At-home fitness companies such as Peloton and streaming companies such as Netflix saw their prices being smashed in April in the post covid peak.

The crypto industry was not unaffected by the market moves - going against to what some investors have believed - as people who owns crypto also owns stocks and, even the crypto class appears to be unlinked to stocks, it is still linked because of investor confidence and sentiment in the future.

Do not panic

Just pay attention to what happened to the markets in February and March 2020 and what happened after.

If you have a long-term goal or strategy, maybe now is the time to buy, if the stocks or assets that you have been watching are now trading lower than in the past. If you are closer to retirement, hopefully you’ve seen your investments move away from risk into something less volatile than stocks. If not, maybe now is the time to do it.

If investing is like gambling, think which casino does not win in the long run and set the basis for your long shot, hopefully, having a strong grasp that markets will show declines but for that they must go high before and vice-versa.

Trustful trading

For a secure and trustworthy experience within trading, you can refer to our Brokers Review Section in order to help you in the process of selecting and opening an account.

We have reviewed some of the best brokers in the market just for you to choose from, namely: